What’s new

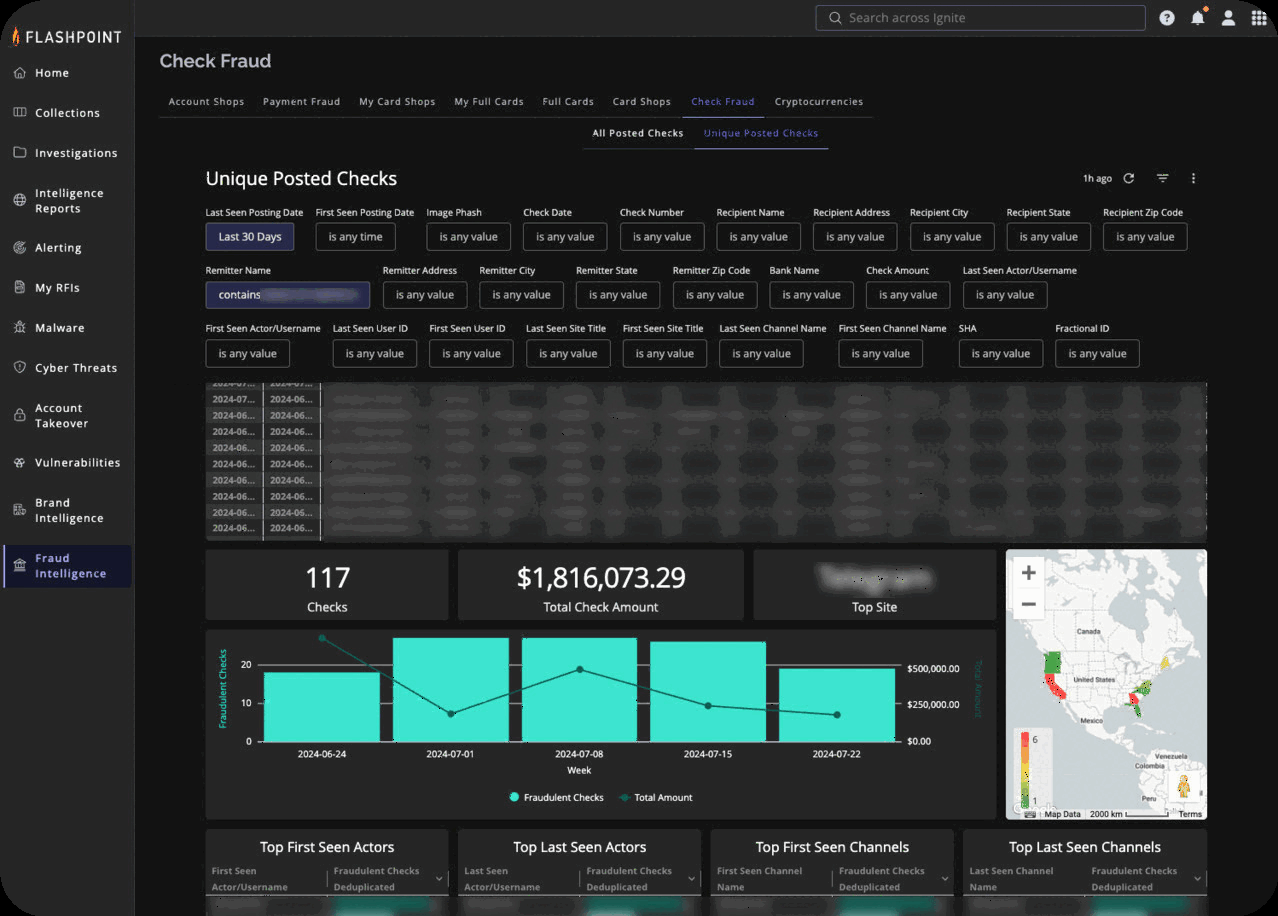

We’re excited to introduce the Check Fraud Analytics dashboard, a new tool included in our Flashpoint Fraud Intelligence solution. This dashboard provides users with comprehensive analytics and data extraction capabilities specifically designed for analyzing check images. It offers two distinct views – “All Posted Checks” and “Unique Posted Checks” – allowing for more nuanced analysis of check fraud activities.

Why it matters

Previously, customers relied on our Image search, using OCR technology, within Flashpoint Ignite to comb through illicit communities and marketplaces. This allowed users to identify check images related to certain keywords efficiently. However, once relevant images were found, users had to manually sift through each result to extract specific data points, which was time consuming and cumbersome.

The Check Fraud Analytics dashboard now automates this process, leveraging advanced AI, to pull, analyze and consolidate it into a unified view complete with robust filters and metrics. The dual-view approach enables users to analyze both the total volume of fraudulent activity and the number of unique checks involved, providing a more comprehensive understanding of check fraud patterns.

With Check Fraud Analytics, you can:

- Quickly identify suspicious check activities and patterns, enabling proactive measures against financial losses.

- Automate data extraction, reducing manual effort and improving response times to fraud incidents.

- Ensure regulatory compliance by monitoring and reporting on fraudulent check activities, enhancing overall risk management strategies.

- Visualize geographic hotspots of check fraud activity, enabling targeted risk mitigation efforts in high-risk regions.

- Quickly spot checks that are repeatedly shared across different platforms or by multiple actors.

- Compare total check volume with unique check instances to identify repeated posting and gain deeper insights into fraud trends.

- Analyze unique check data to get a clearer picture of actual fraud volume without the inflation of duplicates.

How it works

Define your Search

- Choose between “All Posted Checks” and “Unique Posted Checks” at the top of the dashboard.

- You can narrow down the information by setting filters across both views. The more specific you are, the easier it is to find what you’re looking for.

- You can search by: posting date, check number, recipient city/state/zip code, remitter name, remitter city/zip code, bank name, check amount, actor/username, user ID, SHA, and fractional ID.

Big Picture View

- The data table shows you everything from the date the check was posted to the image ID, check details, and the amount.

- You can then click on specific entries to dive deeper and see more information.

Key Metrics

- ‘Total Check Count’ shows you how many checks were processed over a certain period or based off your applied filters. This helps identify trends – are there spikes in check activity that might be suspicious?

- ‘Total Check Amount’ adds up the value of the checks based on your filters. This helps estimate the potential financial risk of fraudulent activity.

- ‘Top Site’ identifies the primary site where fraudulent checks are being posted.

- ‘Top Actors’ highlights the most active threat actors involved in posting fraudulent checks.

- ‘Checks by Weeks’ provides counts of checks and amounts by weeks.

Mapping Fraud

- A dynamic heatmap that displays the geographical distribution of check fraud activity.

- This helps you see if fraud is concentrated in specific regions. This is helpful for banks with branches across a wide area, allowing them to focus resources on areas with higher risk.

Download the Details

- You can download all the data you see, or just specific sets of information, to analyze it in more detail or create reports.

Stay on Top of Things

- Schedule automated reports to be sent directly to your email. This way, you’ll receive regular updates and can continuously monitor check fraud activity.

We are committed to providing our customers with efficient and innovative tools to combat check fraud. The Check Fraud Analytics dashboard, which offers detailed analytics and data extraction capabilities from AI-processed check images, is a testament to our continuous efforts to improve their fraud detection capabilities.